Economy

U.S Treasuries Face Downturn Amid Strong Job Growth

U.S Treasuries are experiencing a notable downturn as American companies added more jobs than anticipated last month. This development presents mixed signals to traders closely monitoring the labor market for indications that the Federal Reserve might need to implement aggressive interest rate cuts in response to changing economic conditions.

Bond Market Reactions

Bonds were already under pressure prior to the ADP private payroll report, which reversed gains from Tuesday when Iran’s missile strike on Israel heightened demand for safe-haven assets. This geopolitical tension spurred investors to seek security in government bonds, which had seen a recent rally. However, longer-term bonds led the decline in yields, with 10-year yields surging 8 basis points to reach 3.8%. This selloff in U.S Treasuries coincided with a widespread decline in European bonds, as yields for U.K. 10-year gilts climbed 11 basis points, alongside a 3% increase in crude oil prices, further complicating the market landscape.

U.S Treasuries geopolitical tensions have created volatility in bond markets, making investors increasingly cautious amid rising yields and uncertainty, according to wsj news.

Labor Market Resilience

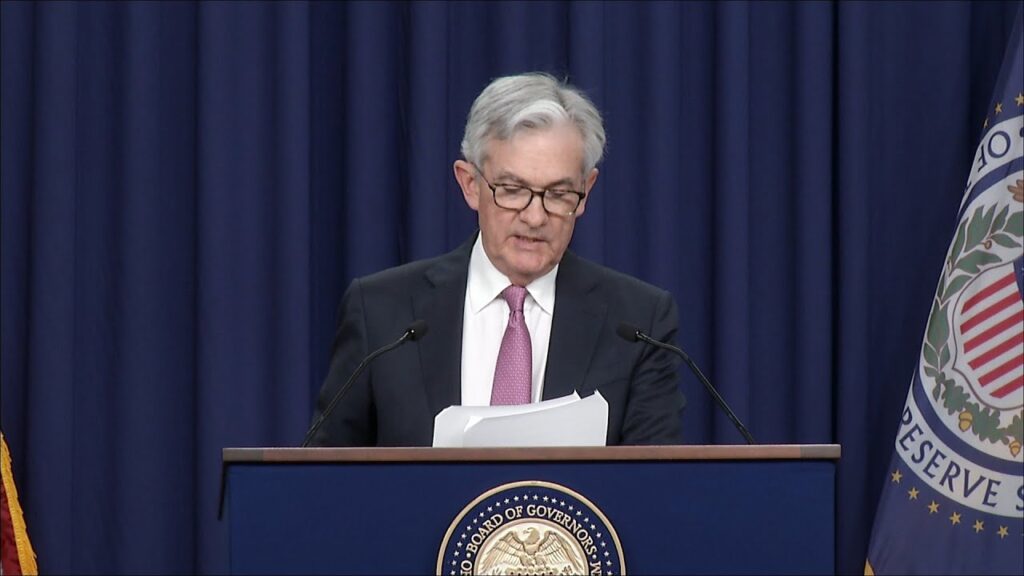

The ADP report followed a stronger-than-expected job openings announcement earlier in the week, suggesting that the labor market remains robust and vibrant. Earlier this week, Federal Reserve Chair Jerome Powell remarked that policymakers are not “in a hurry” to reduce rates, thereby discouraging expectations for a half-percentage-point cut in borrowing costs for the second consecutive meeting. These statements underscore the Fed’s cautious approach in light of evolving economic indicators.

Market Insights

Michael Contopoulos, director of fixed income at Richard Bernstein Advisors, stated, “The ADP employment figures continue to reflect strength in the labor market.” He emphasized, “The notion that the labor sector is collapsing is misguided, and the market is coming to terms with that reality.” This commentary highlights a growing consensus among analysts that the labor market’s resilience could influence the Fed’s future policy decisions.

Bearish Sentiment in Treasury Options Market

A bearish sentiment was evident during the U.S. morning trading session in the Treasury options market. A significant buyer of protection targeted a 5-year yield increase to approximately 3.75% by the end of next week, signaling concerns about future interest rate movements. U.S Treasuries enjoyed a rally over the five months leading up to September, marking their longest winning streak in 14 years as the Fed initiated its rate-cutting cycle. However, 10-year yields have since rebounded by 10 basis points since the Fed’s September 18 meeting, raising questions about the sustainability of the previous rally.

Future Rate Cuts Uncertain

The lingering question revolves around the pace and magnitude of future cuts as policymakers strive to contain inflation effectively. Traders anticipate that the Fed will lower interest rates from around 5% to a neutral level near 2.9%. Such substantial easing is infrequent outside of recessionary periods, raising concerns about potential economic ramifications. This speculation heightens uncertainty in financial markets as traders weigh risks against possible rewards.

Federal Reserve Takes Bold Action A Half-Point Rate Cut

Fed takes bold action: We’ve had a week to reflect on what I believe will be remembered as a historically assertive move by…

Economic Growth and Rate Cuts

The challenge for bond traders lies in the possibility that a resilient economy may limit the Fed’s easing capabilities. For instance, the Atlanta Fed’s GDPNow model indicates the economy is growing at a solid 2.5% annual rate. This economic growth could complicate the Fed’s approach to rate cuts in the near future. Tatiana Darie, a strategist, stated that Powell’s remarks dampened aggressive market expectations for additional Fed cuts this year.

Divergent Perspectives on Rate Cuts

“Financial markets are thriving, equities are at record highs, financing remains accessible, and real estate values are rising in all markets,” remarked Marc Rowan, CEO of Apollo Global Management Inc., during an interview on Bloomberg TV. “Yet, we’re still stimulating. It is unclear whether more rate cuts are necessary at this juncture.” This statement reflects a broader debate among financial leaders about the appropriate path forward for monetary policy.

ADP Report Highlights Job Growth

The ADP Research Institute’s report revealed that private payrolls increased by 143,000 last month, exceeding the median estimate of 125,000. Although the report is not as reliable as U.S. Department of Labor data, it still provides valuable insights. Economists anticipate that government data released on Friday will show a rebound in job growth and a stable unemployment rate. This potential increase in job growth could further influence Fed policy, as strong labor market indicators correlate with inflationary pressures.

Caution Ahead of Presidential Election

Subadra Rajappa, head of U.S. rates strategy at Societe Generale, noted that investors are likely to “remain cautious.” This caution comes just two days before Federal Reserve officials convene, highlighting broader uncertainty in financial markets. Stakeholders await clearer signals regarding economic direction and potential policy adjustments. As the presidential election approaches, political developments and economic indicators will shape investor sentiment and market dynamics.

Subscribe for two years to The Economist and The Wall Street Journal Digital for daily news on your devices. Enjoy a 77% discount, including exclusive content and accessibility across platforms.