Economy

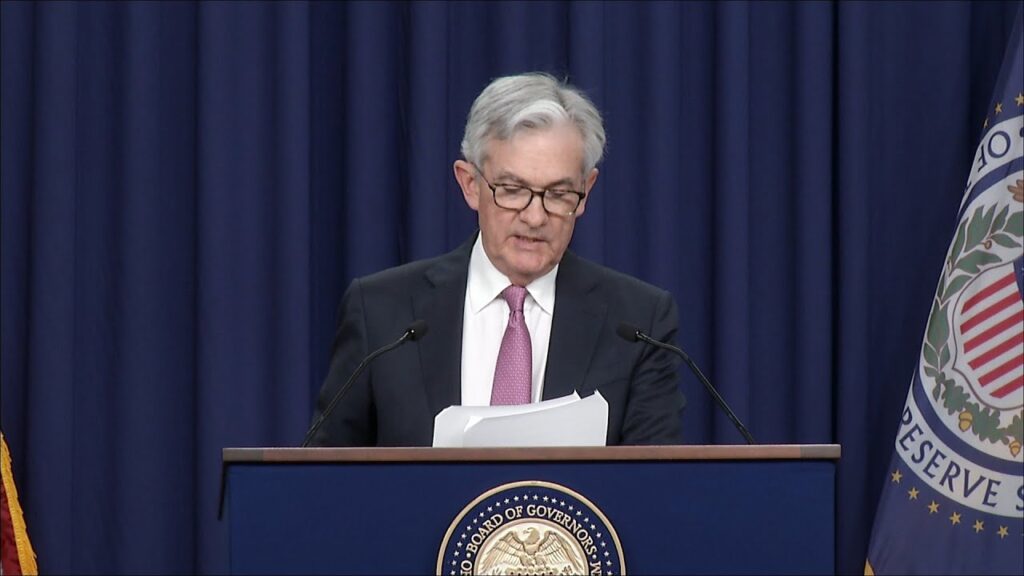

Federal Reserve Takes Bold Action A Half-Point Rate Cut

Fed takes bold action: We’ve had a week to reflect on what I believe will be remembered as a historically assertive move by the Federal Reserve a half-percentage-point interest rate cut. Equity investors view this as a clear positive, driving stocks to record highs. Meanwhile, bonds have slightly sold off, signaling improved odds for a soft landing. This situation has led to higher yields and lower bond prices.

Medium-Term Market Outlook

I believe these market reactions are correct for the medium term. Stocks can continue to climb if the economy remains stable. Meanwhile, bonds will wait for a recession for their moment to shine. Historical context highlights key points along the way for both assets. Understanding these dynamics is crucial for making informed investment decisions in this environment.

Market reactions are justified; stability may drive stock growth while bonds await recession opportunities, according to wall street journal login.

Understanding Tail Risk

In markets, the greatest concern is often tail risk, where unforeseen events with low probability suddenly occur, causing massive disruptions. When markets rally or collapse, investors rush into the same trades, creating “fat tails” on the bell curve of outcomes. The dreaded left tail, representing negative outcomes, is what investors fear most. The Fed has essentially reassured the market, saying, “We’ve got this covered,” effectively ruling out worst-case scenarios.

Mitigating Recession Fears

This assurance is critical because, over the summer, markets were almost panicked about a potential recession. Had that recession materialized, we would have seen widespread selling as investors rushed to reduce risk. Recent data has mitigated the likelihood of an imminent recession, and the Fed’s aggressive half-point cut makes that scenario even less likely. The Fed stands ready to act decisively if the economy falters, with several more percentage points of rate cuts still available.

A Historical Perspective

This move is unprecedented. It might seem like a routine precaution, but the Fed has never made such a significant cut without an ongoing recession. Since targeting the fed funds rate in the early 1980s, the central bank has only made jumbo cuts when a recession or crisis loomed, as seen in 1991, 2001, 2007-2008, and 2020. Each time, the Fed acted in response to severe economic downturns or crises, never proactively until now.

Federal Reserve Poised to Lower Borrowing Costs

The Federal Reserve is set to conclude its two-day meeting on Wednesday with a crucial decision on borrowing costs…

Shifting Priorities at the Fed

The Fed’s dual mandate now interprets broader responsibilities. Historically, it mainly focused on controlling inflation and tightened policy preemptively when unemployment dropped to what officials deemed too low. This focus led to rate hikes to prevent wage inflation and excess demand, even at the risk of recession. However, Fed Chair Jay Powell’s recent actions show a shift in priorities. By making a preemptive half-point cut, the Fed signals a willingness to address both employment and inflation equally, marking a new era for monetary policy.

What Lies Ahead?

What happens next depends on whether the Fed takes bold action and if its intervention has come in time. Monetary policy operates with a lag, which means a recession is still possible. The full effects of rate cuts may not be felt immediately, creating uncertainty. However, I believe a recession is unlikely, though caution is warranted. It’s essential to consider the potential unwinding of the AI investment bubble during this period.

Historical Trends Favor a Soft Landing

A soft landing is generally favorable for stocks. Post-World War II data shows that during economic expansions, stocks rarely stay down for long. Among several instances of market corrections, only one—1962—saw significant stock declines without a recession. Even then, stocks rebounded by 30% within a year.

Thus, it’s not time to be bearish. “Buy and hold” remains a sound strategy during expansions, as de-risking ahead of a recession tends to be counterproductive. Corporate earnings continue to drive stock prices higher, and as long as the economy grows, market charts should continue to trend upward.

Bond Market Repricing

Bonds are repricing as market conditions shift, signaling changes in investor sentiment. While losses in bonds seem unlikely to be severe, caution remains essential. Yields may rise slightly as the Fed’s rate cuts loom on the horizon. Investors should lock in yields effectively before rates decrease further. Always consider your risk appetite when deciding how to proceed in this environment.

Other Asset Classes and Risks

As for other asset classes like corporate bonds and high-yield securities, the Fed takes bold action, providing reassurance for investors. Even Bitcoin benefits from the Fed’s signals, suggesting these assets won’t decline significantly. However, there’s a risk that investors might take on too much risk. This could artificially inflate these markets, creating unsustainable valuations over time. Once recession fears resurface, these inflated markets may face significant corrections, highlighting the need for caution.

Buy and Hold Strategy

In summary, the biggest takeaway is that the “buy and hold” strategy works. Stocks rarely stay down for long during economic expansions, as seen in 1962, 1987, and even in 2022. The question arises when considering how to navigate recessions. Conventional wisdom suggests riding them out, and looking back at March 2020, that approach proved correct. The swift policy response in 2020 may serve as a blueprint for future recessions under the Fed’s new strategy.

Subscribe to the WSJ and Barron’s News for two years and enjoy unlimited access on iOS, Android, PC, and Mac. This includes articles by Peggy Noonan, Barron’s stock picks, live TV, audible articles, and the magazine.