Economy

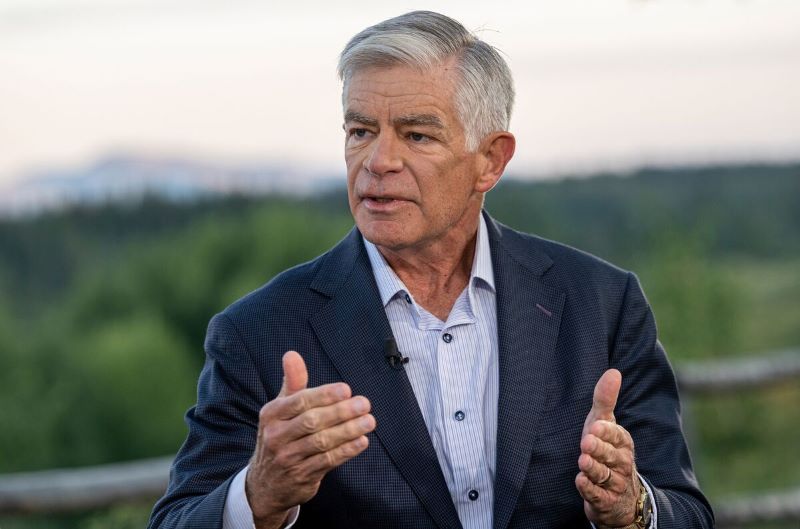

Philadelphia Fed President Warns of Inflation Challenges

Philadelphia Fed President Patrick Harker maintains that inflation will gradually decline toward the central bank’s 2% target. He voiced concerns over risks. Harker emphasized that the decline in price growth could be at risk. The central bank remains focused on addressing inflation’s challenges.

Increasing Pressures on Inflation

During a recent event with educators at the Philadelphia Fed, Harker clarified, “I’m not suggesting it won’t happen.” He added, “However, it appears there are mounting pressures that might prevent this from occurring.”

Fed’s Stance on Interest Rates

Following a full percentage point reduction in borrowing costs late last year, Fed officials have indicated that they are likely to maintain current interest rates for some time. They assert that further confirmation of inflation aligning with the 2% target is necessary before any action is taken.

Uncertainty Surrounding Economic Outlook

Harker emphasized the uncertainty surrounding the economy, particularly the impact of President Donald Trump’s policies. “In such an environment, decisions don’t move swiftly in either direction,” Harker remarked, noting that it makes it difficult for the Fed to make firm policy decisions.

What Trump Said in His Speech to Congress!

President Trump speech to congress, emphasizing transformative changes across federal agencies, aiming…

Trump’s Tariffs Add Complexity to Economic Forecast

This week, President Trump imposed tariffs on most goods from Canada and Mexico and a 20% duty on imports from China. Despite these measures, the White House granted automakers a one-month exemption from tariffs on goods from Mexico and Canada, underscoring the rapid shifts in tariff policies.

Potential Impact on Consumers and Economic Growth

Economists predict these levies could result in higher prices for consumers and slower economic growth. Data from early this year showed a decline in consumer spending in January, with both businesses and consumers growing more pessimistic about the economy’s future.

Diminishing Business and Consumer Confidence

Harker highlighted that business and consumer confidence is fading, signaling potential economic challenges. This is a concerning trend. The fading confidence points to risks ahead for the economy. Harker warned that this could further complicate economic recovery.

Fed’s Next Meeting and Policy Decisions

Harker also pointed out that rates are currently sufficiently restrictive to curb inflation, indicating support for keeping rates unchanged. The Fed’s next meeting is scheduled for March 18-19, where further policy decisions will be discussed.