Real Estate

Office Owners Reeling From Remote Work Now Fret About Recession

Many employers need less work space, and rising interest rates can push down property values

Rising interest rates and growing recession fears are compounding the woes of office landlords grappling with the spread of remote work.

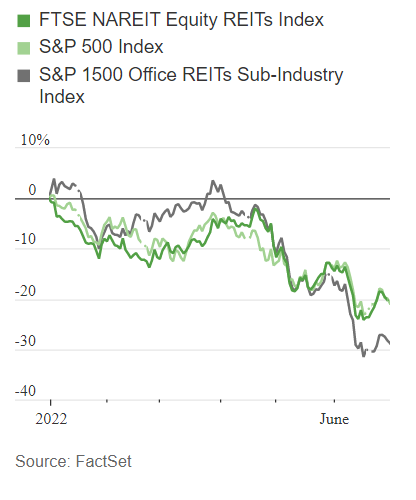

An index tracking the shares of publicly traded office owners was down 29% over the first two quarters, compared with a 21% decline by the S&P 500 stock index. Office stocks plunged in June, as weak economic indicators and persistent inflation made a recession appear more likely.

Office leasing tends to be highly dependent on the health of the economy. During recessions, companies often cut costs by laying off workers, meaning they need less space. Rising interest rates also hurt office landlords because they tend to push down property values.

Get New York Times Digital Subscription 3 Years

Office Wose

U.S Office Occupancy

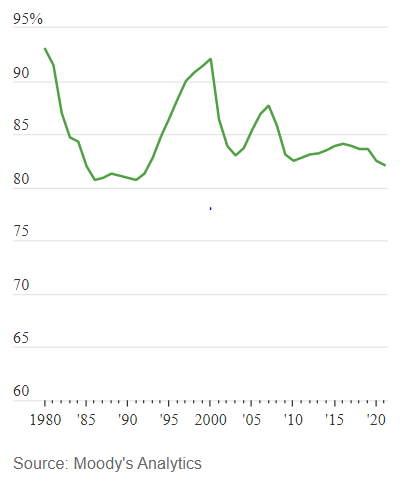

The last three recessions all led to a drop in office occupancy, according to data from Moody’s Analytics.

Thanks to more office supply and companies squeezing more employees into smaller spaces, the share of U.S. office space leased today is far lower than it was at the start of the 2001 recession or the subprime crisis. While office demand continues to be strong in many Sunbelt cities, vacancy rates in cities like New York, San Francisco and Chicago rose during the pandemic, in some cases to the highest levels in decades.

At the start of the year, landlords were hoping that the second half of 2022 would see a surge in leasing as more companies sent their employees back to the office. That is now looking less likely, said Daniel Ismail, senior analyst at real-estate-analytics firm Green Street.

“There are few silver linings in the near term,” he said. Many companies adjusted to remote work over the past two years, making them more likely to ditch office space if they need to cut costs during an economic downturn, Mr. Ismail added.

Buy Bloomberg Digital Subscription 5 Years

How bad things get for the office sector depends on the severity of the downturn. During and after the 2020 recession, the national office vacancy rate barely fell because the drop in output was sharp but brief.

Few office-using workers were let go, said Kevin Fagan, head of commercial real estate economic analysis at Moody’s Analytics. But if rising interest rates were to lead to mass layoffs and corporate defaults, vacancy rates could rise substantially.

The combination of weak demand and rising interest rates is pushing down prices. Green Street estimates that office-building values have fallen by 8% this year. While some modern buildings are still getting high prices, investors and lenders say they are increasingly reluctant to spend big on aging office properties.

Some are backing out of deals altogether. Property investment firm Harbor Associates LLC signed a contract in May to buy the 40-story Union Bank Plaza office tower in Los Angeles for $165 million, according to a Securities and Exchange Commission filing by the seller, an affiliate of real-estate investor KBS.

Subscribe To Wall Street Journal Newspaper | WSJ Newspaper | WSJ Print Save 30% Off

That price was around $40 million less than KBS paid for the property in 2010. Even so, Harbor backed out of the deal less than a month later, KBS said in a securities filing. A Harbor spokesman declined to comment.

Despite these headwinds, the share of office mortgages that are delinquent remains low. Landlords generally hold less debt than before the 2008 recession, providing a valuable buffer during a downturn. Still, lenders and analysts say they expect more defaults.

Craig Bender, head of commercial real estate in the Americas at Dutch bank ING Groep, said he is still bullish on modern office buildings in good locations but is shying away from lending against older, cheaper properties.

“There’s going to be distress in that asset class,” he said. “There’s no question.”