Markets, Technology

Crypto Panic Overshadows A Few Banks As FTX Legal Troubles Continue To Grow

Crypto – During the Great Depression, banks fell like dominoes due to a classic run: depositors withdrawing cash en masse on fears that lenders were racking up losses and bad loans, reports WSJ Print Edition.

Now, with cryptocurrencies, depositors run into trouble first.

California-based Silvergate Capital Corp., which offers digital asset firms a place to park their cash, shocked its investors after reporting it recently had an $8.1 billion reduction in deposits. For perspective, that’s 70% worse than what you experienced during the depression. But in that case, the depositors themselves made bad bets, a list of crypto entities that includes parts of Sam Bankman-Fried’s doomed FTX empire, reports First American News.

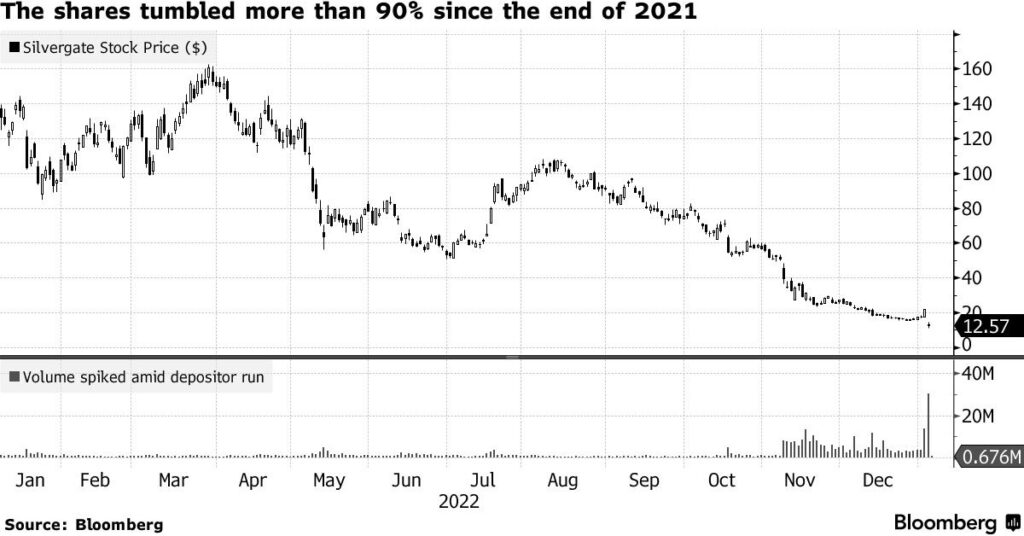

Silvergate’s Tarnished Stock

“This is unprecedented, it’s very unusual,” said Karen Petrou, a managing partner at Federal Financial Analytics, a Washington-based research firm. “Because they were so dependent on crypto funding, they were vulnerable for a run. Given the crypto market has been unstable, they got it.”

Bank regulators, she said, will take a closer look at such situations.

Indeed, earlier this week the Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency issued an unusual joint warning to banks that deal with crypto firms, expressing concerns about business models that are too concentrated in crypto-related activities.

“It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system,” the regulators said.

Silvergate expressed confidence in its liquidity and ability to move on, a notion supported by several Wall Street analysts. But Silvergate’s disclosure — which included selling assets at a loss to raise cash — sent its stock tumbling, bringing its total slide to more than 90% since the end of 2021, the year Bitcoin reached a record high.

In other modern bank crises, such as the 2008 credit crunch that claimed Bear Stearns Cos. and Lehman Brothers Holdings Inc., problems began as souring loans and other assets chewed holes in lenders’ balance sheets. As those losses mounted, funding sources panicked and pulled away.