World

ECB Interest Rate Cuts Amid Economic Challenges and Trade Uncertainty

The European Central Bank (ECB) interest rates cuts to stimulate economic growth in the region. This move comes as Europe faces threats of tariffs imposed by Trump and the urgent need to significantly increase military spending. On Thursday, the ECB cut its main interest rate from 2.75% to 2.5%, marking the sixth rate cut in seven policy meetings.

Possibility of a Pause in Rate Cuts

ECB President Christine Lagarde suggested that the bank might pause the rate cuts in upcoming meetings, including the one in April. During a press conference in Frankfurt, Lagarde stated, “We are moving towards a more gradual approach, considering the path we have taken.”

Impact of Trump’s Tariffs on Europe’s Export Economy

President Trump’s proposed tariffs pose a significant threat to Europe’s export-driven economy. The ECB revised eurozone growth projections. It now forecasts 0.9% growth this year and 1.2% next year. Inflation expectations were also adjusted upwards to 2.3%.

Political and Economic Instability Due to Trade Uncertainty

The ECB pointed out that growth prospects are weakened by declining exports and stagnant investment, mainly driven by the instability of trade policies and widespread political uncertainty. The United States remains Europe’s largest export market.

Germany’s Plan Could Boost Long-Term Growth

Despite the uncertainty, Germany’s proposed plan to spend up to €1 trillion on defense and infrastructure could strengthen the economy in the long run. Although it has yet to be implemented, the plan has already altered growth and inflation expectations across Europe, creating volatility in global financial markets.

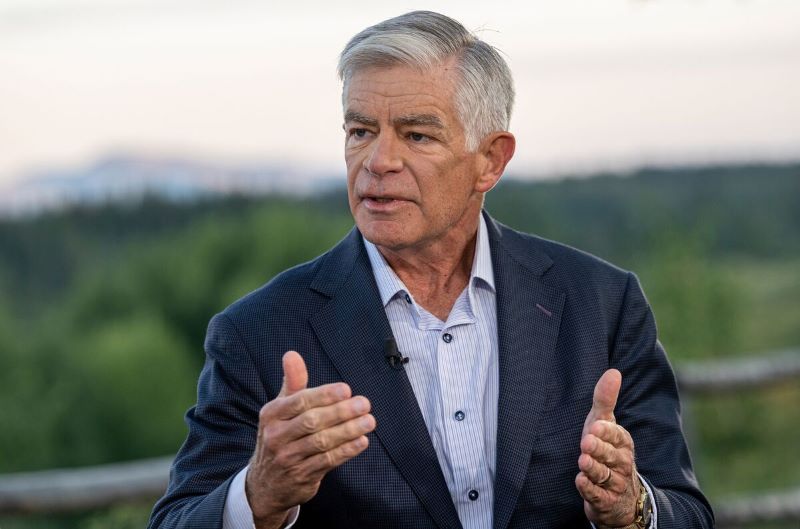

Philadelphia Fed President Warns of Inflation Challenges

Philadelphia Fed President Patrick Harker maintains that inflation will gradually decline toward the central bank’s 2% target…

Market Reaction to Fiscal Uncertainty

European government bonds experienced a massive sell-off on Wednesday and Thursday as investors anticipated higher budget deficits, increased inflation, and potentially stronger economic growth. The euro rose to $1.08 from less than $1.04 in just one week.

Inflation Expectations and the Pause in Rate Cuts

This spending package could drive long-term inflation, prompting speculation the ECB may halt rate cuts earlier than expected. Investor expectations for rate cuts have moderated. Cuts are now projected at 0.7 percentage points by December. This is higher than the 0.15 percentage points projected earlier in the week.

Impact of Rate Cuts on European Markets

Following the ECB’s decision, the euro gained about 0.4%, reaching $1.083, its highest level against the dollar this year. German stocks rose by more than 1%, and long-term bond yields across Europe spiked for the second consecutive day, driven by expectations of stronger economic growth.

Uncertain Impact of U.S. Trade Dispute

A trade conflict with the U.S. may slow Europe’s growth in the short term. Its inflation impact is unclear. Recent data shows slow eurozone growth, with inflation nearing the ECB’s 2% target. However, core inflation remained elevated at 2.6% in February.

Expectations of Future Rate Cuts

Analysts anticipate the ECB will continue its rate cuts due to potential new tariffs. Rates are expected to drop. By summer, they could reach around 2%. This move aims to mitigate economic pressure from tariffs.