Business, Economy, Real Estate

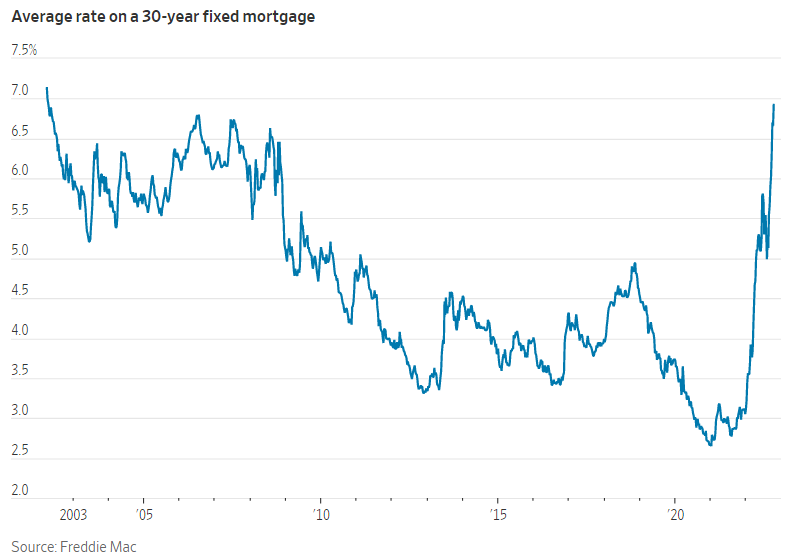

Mortgage Rates Have Risen to Historic Levels

The Wall Street Journal Digital reported on August 13, 2022, that US mortgage rates rose t a level not seen in over 20 years this week; the average 30-year fixed mortgage rate reached 6.92%; this Thursday, Freddie Mac published a survey where he mentions that many lenders are offering interest rates up to 7%, rising from the 3.05% offered a year ago. High-interest rates are making the real estate market less attractive and the oversupply of homes is causing the value of homes to decline nationwide.

The last increase a week ago took the interest rate above the peak percentage of the last financial crisis. The benchmark is up almost 2 points percentage since August, adding to an already brisk rise since the Federal Reserve began raising rates earlier this year.

Subscribe today and get 52 weeks of The WSJ Print Edition with daily delivery for $318

After these interest rates, many buyers have been left out of the possibility of acquiring a home, due to the high monthly cost of paying a mortgage. Such a high-interest rate has turmoil in the real estate market.

The New York Times Digital reported today that buying power has decreased making the housing market less affordable. A buyer with an average income for a family, paying a 20% down payment, could buy a house for approximately $339,000 this week. By comparison, this same buyer could have purchased a $449,000 home in January.

The higher rates have further cooled the housing and mortgage markets. The volume of mortgage rate locks is down 30% in the last three months and almost 60% from last year’s levels, according to Black Knight Inc., a provider of mortgage data and technology. In particular, flat rates for people who refinance to withdraw cash from their homes fell more than 26% between August and September.

Get 5 years of Bloomberg News and The Wall Street Journal combo for $89

“Everything is very quiet,” “The phones just don’t ring,” are some mortgage brokers’ statements.

Mortgage rates tend to go up and down with the yield on the 10-year Treasury note, which recently traded around 4%. The cost of loans it has risen across the board since the central bank embarked on its aggressive campaign to curb inflation.

“We continue to see a tale of two economies in the data: strong job growth and wages keeping consumer balance sheets positive, while persistent inflation, recession fears, and housing affordability are causing housing demand to drop precipitously” Sam Khater, Freddie Mac’s chief economist, said in a statement.